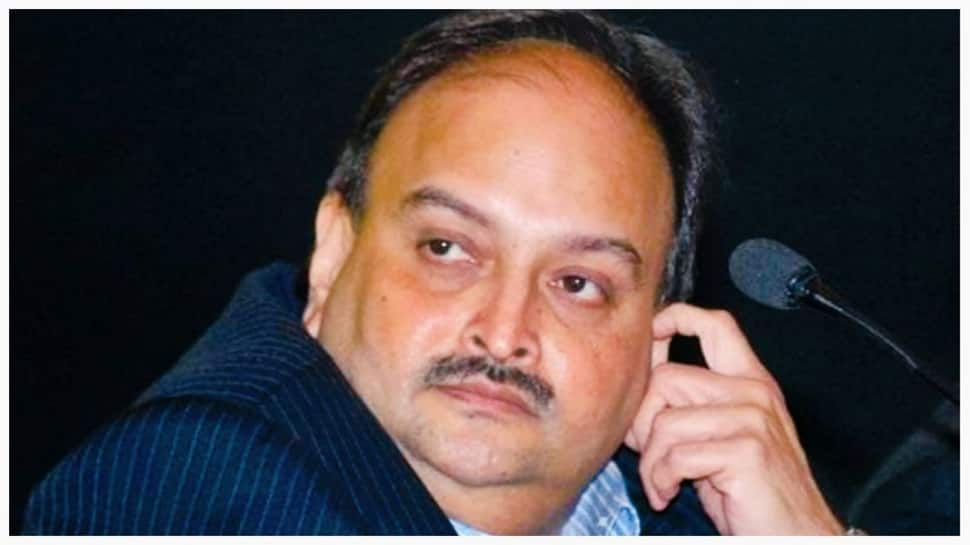

Mehul Choksi, The Story Of A Defaulter: According to data submitted to Parliament, the top 50 willful defaulters owed Indian banks a combined sum of around Rs 92,570 crore as of March 31, 2022. Mehul Choksi, a fugitive diamantaire who defaulted on loans totaling Rs 7,848 crore, tops this shameful list. Mehul Choksi, who was born in Gujarat, is well-known for the Punjab National Bank (PNB) scam, in which the public sector bank was defrauded of more than Rs 13,500 crore. Along with his nephew, Nirav Modi, he is charged with being the scheme’s creator. The money siphoning wasn’t found until 2018, almost eight years after the Choksi-led Gitanjali Gems started plundering PNB. Just a few weeks before the PNB scam was disclosed on February 15th, Choksi’s role came to light; by that time, the rich businessman had left for greener pastures. On January 7, 2018, Choksi boarded a flight for Antigua.

Mehul Choksi: Wilful Defaulter

Mehul Choksi and his nephew Nirav Modi used to appear frequently at the yearly events for the gem and jewelry sector held in five-star hotels in Mumbai. In this field, they held a commanding position. Using only his personal guarantees, banks lined up to lend money to Choksi’s Gitanjali firm. When the Punjab National Bank (PNB) scandal involving Rs 13,500 crore occurred in February 2018, everything changed. Following his departure from the nation, Choksi is now regarded as a “wilful defaulter” by Indian law enforcement organizations, including the Central Bureau of Investigation (CBI) and the Enforcement Directorate (ED).

Mehul Choksi: PNB Scam

The PNB scandal is centered on the Gitanjali Group, a retail jewelry company with about 4,000 outlets in India. Choksi’s Gitanjali Gems started a series of transactions at PNB starting in 2011 that weren’t recorded in the bank’s Core Banking Software (CBS), with the help of some employees at the public sector bank.In addition, over 165 Letters of Undertaking (LoU) were erroneously granted to Choksi’s businesses. Before the LoUs were granted to Choksi’s companies, there were no securities held in reserve, which is where the deception resides. Hundreds of Foreign Letters of Credit (FLC), many of which were greatly overvalued, were also issued in addition to the fake LoUs. Another short-term credit option for international trade is an FLC. Even in this situation, Choksi was able to raise money despite not being creditworthy to do so. The victims of Choksi’s payment problems weren’t just PNB. Gitanjali Gems also fell behind on payments for loans obtained from ICICI Bank, IDBI Bank, and the Life Insurance Corporation of India (LIC). Additionally, it was determined that Choksi’s jewelry store violated various FEMA regulations.

Mehul Choksi: Antigua-Drama

Choksi most certainly anticipated being caught red-handed and knew it beforehand. Choksi and his family left the country in January 2018, before the full extent of the PNB scandal could be revealed. Just a few days prior to PNB filing a formal case with the CBI, they arrived in legendary cricketer Sir Viv Richards’ Home Town Antigua. It is important to note that Choksi petitioned for citizenship in the Caribbean nation in May 2017 alone. This demonstrates that the diamantaire had no intention of paying back the loans and that his decision to leave the country after failing was deliberate. Criminal conspiracy, criminal breach of trust, fraud, deceit, corruption, and money laundering are among the numerous cases now filed against Choksi. Since Choksi became an economic fugitive, India has been working to have him extradited after the CBI was able to convince Interpol to issue a Red Notice against him.

Debt And Recovery

Along with his nephew Nirav Modi and the previous owner of a beer empire, Vijay Mallya, Choksi is a wanted felon. The three of them have a combined debt to Indian banks of almost Rs 22,000 crore. There was some solace in the fact that the central government had informed the Supreme Court that it had recovered Rs 18,000 crore from assets belonging to Mallya, Modi, and Choksi. These three currently have attached assets worth Rs 19,312.20 crore. The public sector banks have received a refund of Rs 15,113 crore of this total.

A prompt extradition of Choksi to India now appears to be very unlikely unless the Indian government increases pressure. Choksi is wealthy, has a large legal staff, and is well-connected in the Caribbean. Before Choksi is brought back, India may have a protracted battle on its hands.

zeenews.india.com

Source link